Reflections on Black Friday 2024

My bet is the makeup of companies that take part next year will look different.

Firstly, welcome to our new subscribers. Since we launched our annual paid social report, we’ve had a few hundred more signups. To read the social report, head here.

3rd June.

That was the date I received my first email telling me it was time to start getting ready for Black Friday.

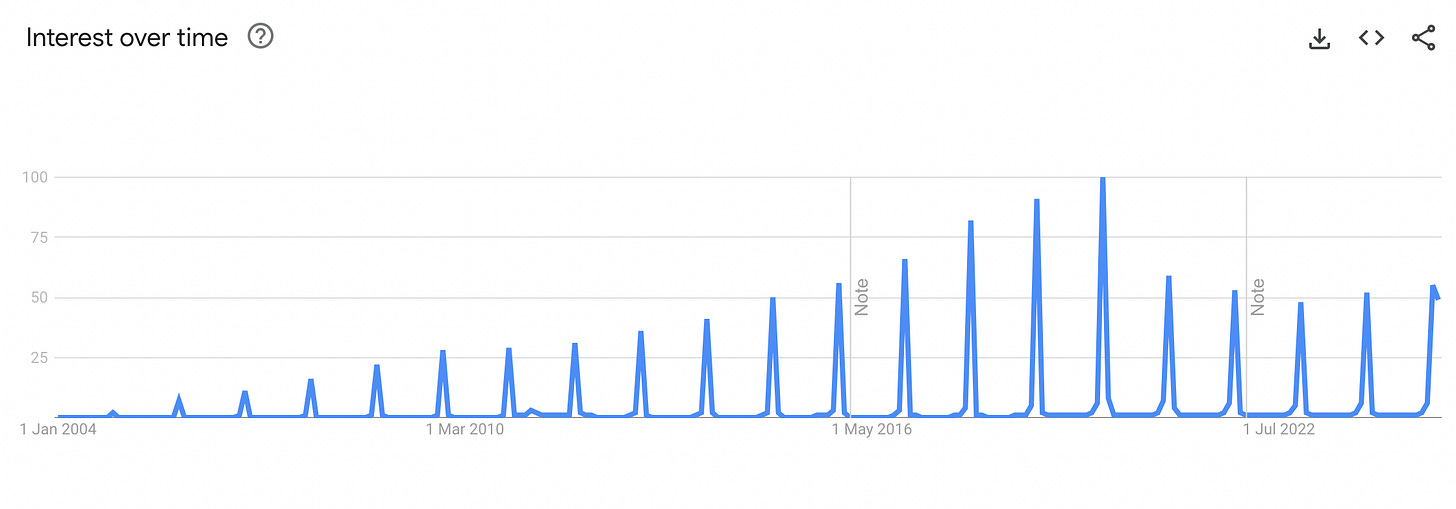

The global peak for Black Friday, according to Google Trends, was 2019. B…