Scaling? What does that conversion really cost

The "incremental" cost per conversion

I used to hate the word ‘incremental.’ I remember when I first heard it – from someone at an agency when I was in-house.

It felt like marketing jargon, and once I learnt why they were saying it, I thought it was redundant. “I know when we increase spend conversions go up” was my gut response.

Fortunately in the 12 years since that moment, my thinking has grown. But I think its useful to flag as a starting point in case you right now turn away when you see the word.

Today, I want to talk about this in terms of the true cost of scaling.

The reason? I’ve seen incredibly smart people – founders, CEOs, and CMOs – not consider what I’m going to talk about today.

And the downside of what I’m talking about is that what you might consider to be “profitable” isn’t in fact profitable. And what you consider to be ‘good scale which you spend into’ might not be that at all.

The incremental cost per conversion

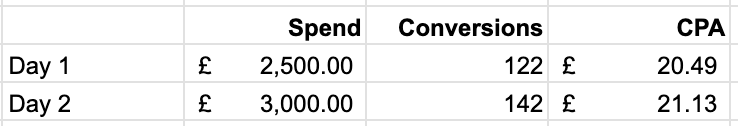

Let’s imagine a scenario.

Let’s go back to December and you’re there surf scaling / vibe scaling / whatever scale technique you prefer these days.

Let’s imagine target CPA for this account is £22.

Day 1 you see great performance and you’re under target, so you scale 20%.

Day 2 you’re at £3k of spend and your CPA is still under target.

What do you do? Maybe pause at this point and consider what you’d do in this decision.

Most people would scale again. In fact, we should potentially be pulling back.

It’s logical as to why you think like that: we’re under target CPA, happy days, right?

Except, you paid £20.49 for your first 122 conversions, and then you put £500 of extra spend into the account.

That £500 of extra spend resulted in 20 additional (or incremental) conversions meaning those conversions cost you £25 each. These are now £3 over target.

Of course, this happens at every level. As a general principle, conversions cost more over time. You are hit by diminishing returns. Companies have them, channels have them, audiences have them, creatives have them.

And so actually those first 122 conversions didn’t all cost £20.49, some probably cost you £10 and some £15 and so on. So you are already making some tradeoffs.

When you should scale

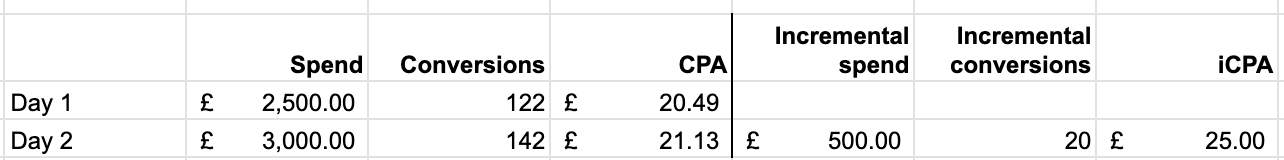

There’s a clear no-brainer time to scale.

If you push scale and your CPA stays the same – or roughly thereabouts – then you’re in great territory.

At this point, we scale again. And we keep pushing until that equilibrium breaks.

The ability to do this is predicated on a mixture of: market, product, customer, marketing.

→ Doing great marketing allows you to do this.

→ Improving your product allows you to do this.

→ Customer developing new needs allows you to do this.

→ Market growing (either organically or through your marketing) allows you to do this.

The external factors are big here. And we know that because those of us who were scaling hourly throughout Black Friday, or daily throughout December, will know how much external factors govern ability to scale.

Long term budget setting is bad for social

This is why long term budget setting for social is bad.

Long term budget setting is very corporate. Those who see social in the same way you think of TV ad buys or OOH campaigns. "You set a monthly budget for social at the start of the year and just spend it throughout the month.

But that’s actually bonkers.

In instances like that, you leave opportunity on the ground when things are great, and you’re worsening low efficiency when things are poor.

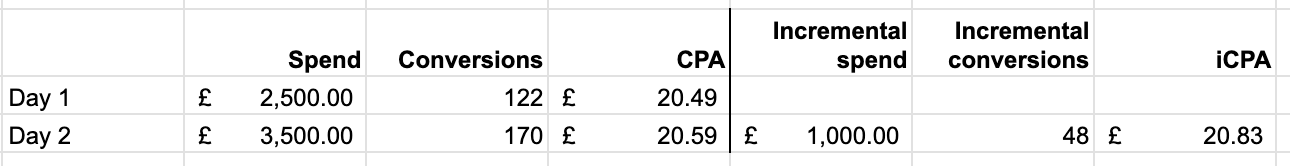

Scale dilemma in December 2025

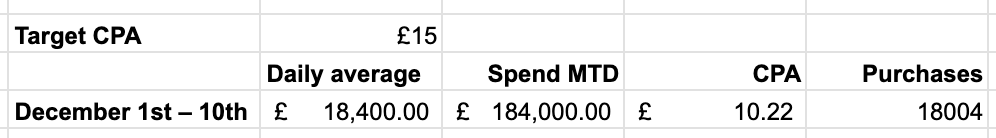

Here’s one exact situation we had with one client this December.

We were in this situation. We were £4.78 under target CPA and spending really well. The question was very obviously: do we scale?

When you’re spending £18k per day and getting over 1.8k purchases this puts you into a tricky incremental position.

The challenge was – let’s spend up to the target CPA.

Now, how do we model whether that’s worth it.

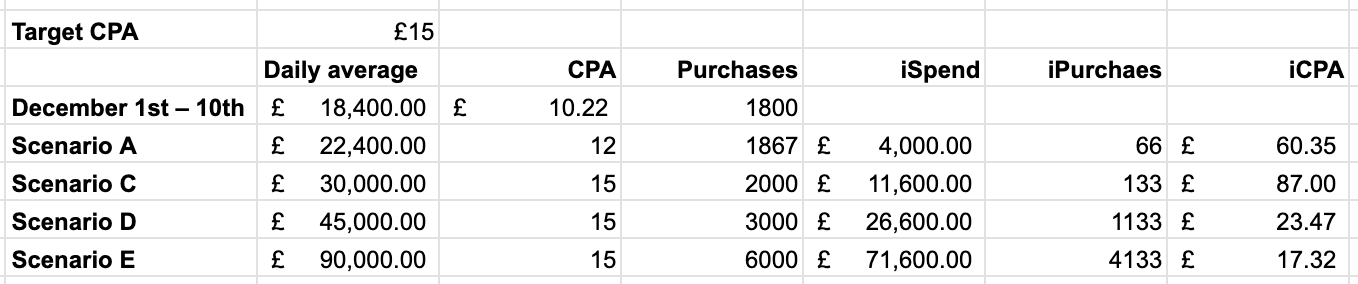

Starting route was to consider what had happened at recent spend increases. We looked at some historic pushes and thought a 20% increase in spend might lead to a 15-20% increase in CPA. Except we quickly realised the incremental cost of those conversions would be £60.35 each. I.e. they ain’t ever going to pay back.

Then we began a thought experiment.

What if hypothetically we could hit target CPA? What would spend need to be to make sense.

Until you get to £90k/day you’re paying significantly over your target CPA for that incremental volume. And even then you’re still 15% higher than target – and these customers likely have worse LTV.

We of course then hit other issues around incrementality and diminshing returns which is – if we ramp spend that much, it’s highly unlikely we’ll hit that blend CPA. In fact if we 5x-ed spend, our hunch is actual CPA would skyrocket.

Now perhaps you look at this and you think you’d be happy to take 1k extra customers per day at £23.47 – so long as the average was £15.

But at this point there are probably more cost effective ways to spend £26.6k of spend – which deliver lower iCPA. And this is when channel or market or product diversification should be properly reviewed.

There are channels that might deliver £20 CPA usually that seem expensive, but actually they provide more incremental balance than Meta does at scale.

Scale with increasing CPA is costing you more than you think

Some diminishing returns is inevitable. And so this isn’t a question of ‘never spend’, but there does become an s curve where you should be happy or not to push.

A core reminder: if you’re increasing spend and CPA is going up, you’ll be paying more for each conversion and they are more costly than your blend reveals.

Our role as advertisers is ultimately to help increase spend without CPA going up.

How are you thinking about scaling and incrementality? And how are you using this in budget-making decisions.

Josh Lachkovic is the founder of Ballpoint, a growth marketing agency that helps you profitably grow spend from £30k per month to £500k per month. Visit Ballpoint to learn more, or subscribe to Early Stage Growth for weekly insights on profitable scaling.

This breakdown of incremental CPA is gold. The december example where iCPA would hit £60 while blend stays at £15 is something I've seen play out so many times but never articulated this clearly. I used to work at an ecommerce brand where we kept pushing spend because average CPA looked fine, then six months later realized our actual unit economics were completly upside down. The long-term budget setting critique is spot on too, social needs flexibilty that quarterly plans just cant accomodate.