New year, new you. So goes the saying but what is the new year looking like so far?

With our first full week of Jan behind us, we’ve examined multiple categories and trading is on average slower than expected. As ever in times like this, I speak to friends who work in marketing and are founders.

The picture is not universal – we are definitely seeing some categories outperforming expectation. But, there’s a slow start to the year as well.

I’ve been digging in over the last week to understand how much is market-driven, vs creative, vs internal.

As part of this, I’ve been looking at Google Trends data as a proxy for organic demand to understand how people are behaving this year.

If you like this, please forward it to a friend, leave a comment or hit the like button at the bottom of the page.

The backdrop: December

As discussed last week in my article on incremental volume, we had a lot of very strong successes in December as an agency. With almost every brand, we hit the volume targets for the month.

The negative of December was that CPAs were not as comparatively strong as the year before.

Typically we see behaviour like this:

CPA: December CPA is 60-80% of November CPA

This accounts for higher conversion rates, more market demand etc. What we saw in December was the very definite ability to scale spend – but we didn’t see the CPA drop as we usually do.

Outside of our work, it was a bad month for UK retail. The FT reports that most of the supermarkets saw good spending in premium categories, but step out of the supermarket and it’s a poor trading environment.

This follows research we highlighted in our 2026 futuregaze – the idea that in food categories particularly people are choosing to trade up.

When I’ve spoken to other founders and CMOs, it seems that we had an above-average month of performance, perhaps due to the flexibility to push into more standard year round CPAs. The goal for most of our clients was net profit, not gross margin.

How was your December?

The new health

January is health month everywhere. But not all health months are created equal.

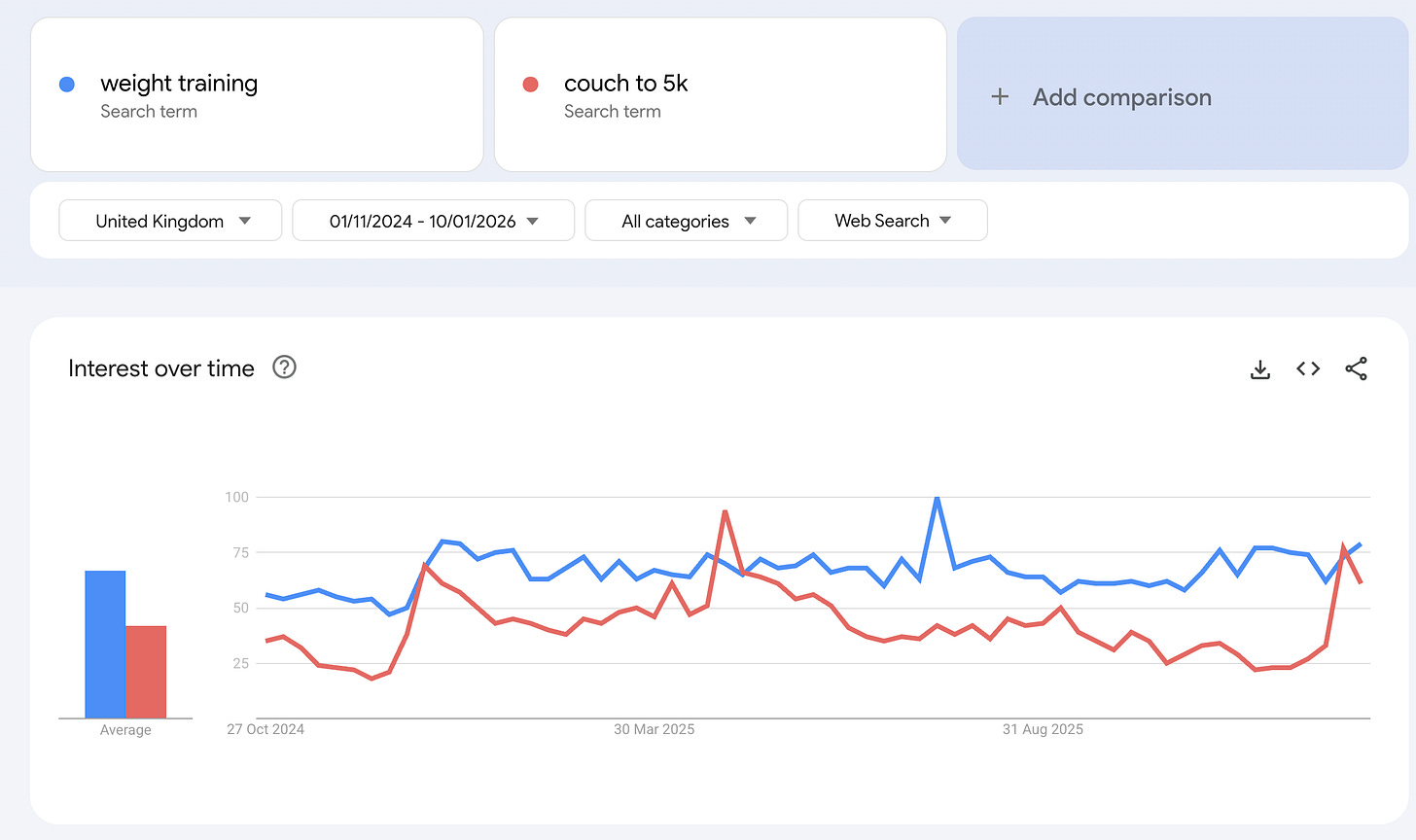

2025 might be the year that GLP-1s entered the mainstream. So much so that it’s changing the nature of what we do in gyms. For the longest time, January was cardio-focused and about weight loss. But, as the FT reports, GLP-1 users need weight training more than ever.

“Unless you do strength training, everything that I’ve been told is that [taking GLP-1s] will be a bit of a disaster for you,” said Russell Barnes, chief executive of upmarket gym chain David Lloyd.

Source: FT

Not only that, but as Osman Ahmed writes, “[toned, sculpted arms] is emerging as the status symbol in certain circles than just being runway model size.” For women in particular, the focus is starting to shift as voices everywhere from sports through to Vogue are starting to advocate for strength over slimness.

But how is that coming through in search behaviour?

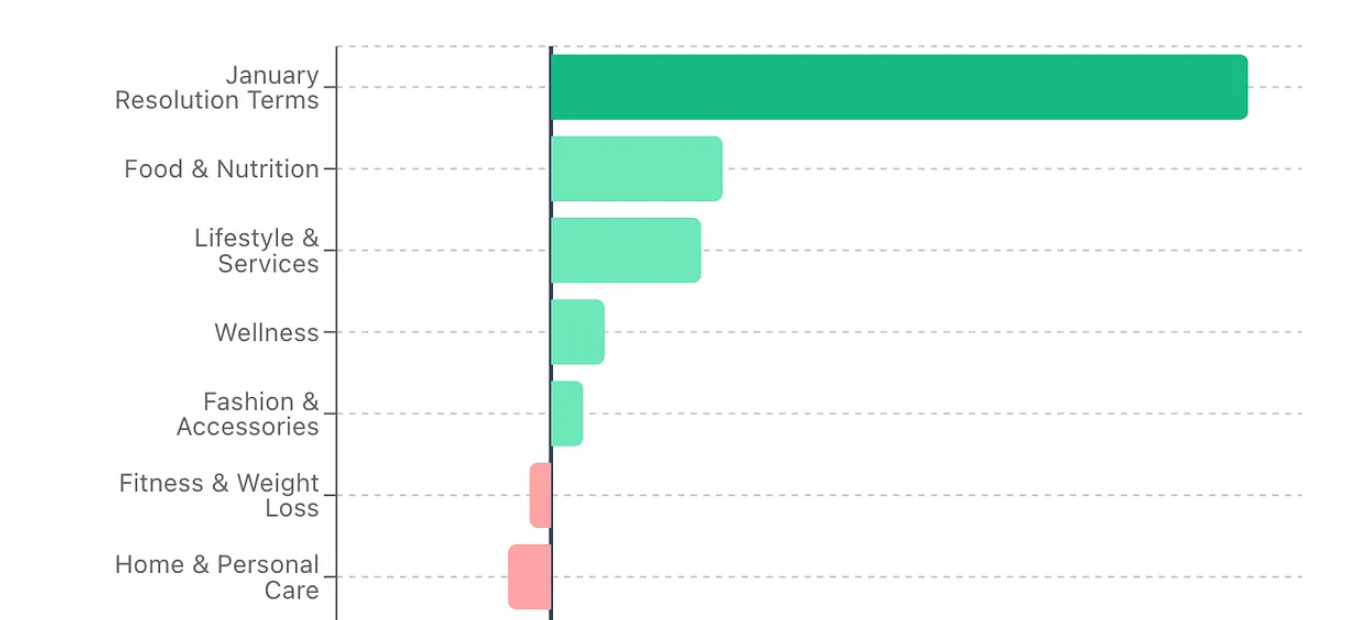

At a high-level, the ‘fitness & weight loss’ category is on a downward trend.

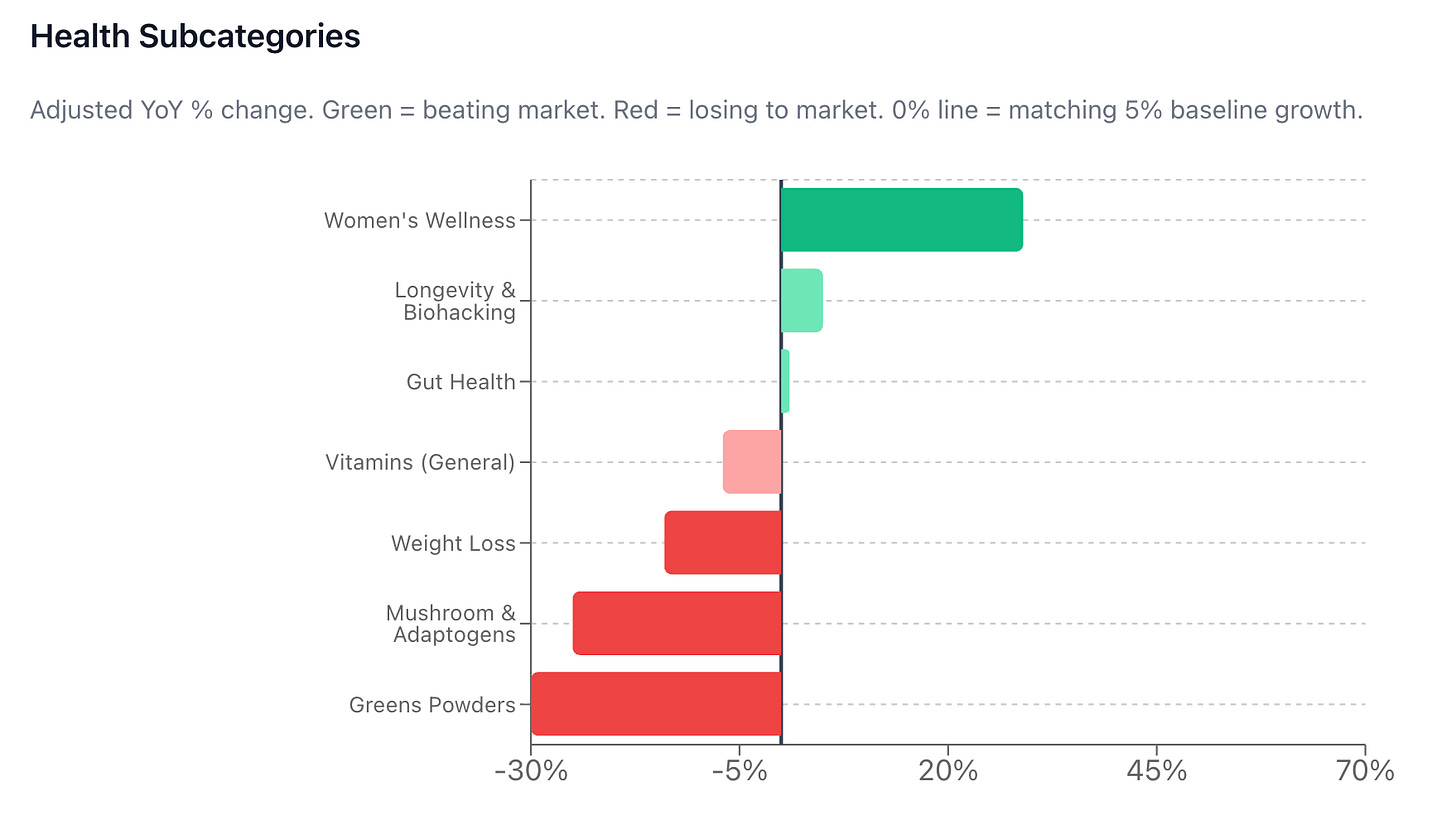

Dig into health subcategories though and you start to see a more granular picture. Weight loss related searches are down, so too are dry January ones, as are mushrooms, and green powders (AG1 in particular is poorly hit).

Looking into some of the individual search terms you’ve got:

Protein powder women: 57% adjusted YOY

red light therapy: 48%

gym memberships: 42%

magnesium: 3%

protein bars: -6%

green juice: -19%

marathon training: -28%

lions mane : -32%

adaptogens: -55%

The vibes, they are a changing.

Some of the big health trends from the last few years are receding as well: cold water swimming, biohacking, and intermittent fasting are all down.

Other new year’s resolutions are similarly mixed. “New job” is up 100% year over year, while veganuary is down. The biggest resolution winner this year is gym’s by far.

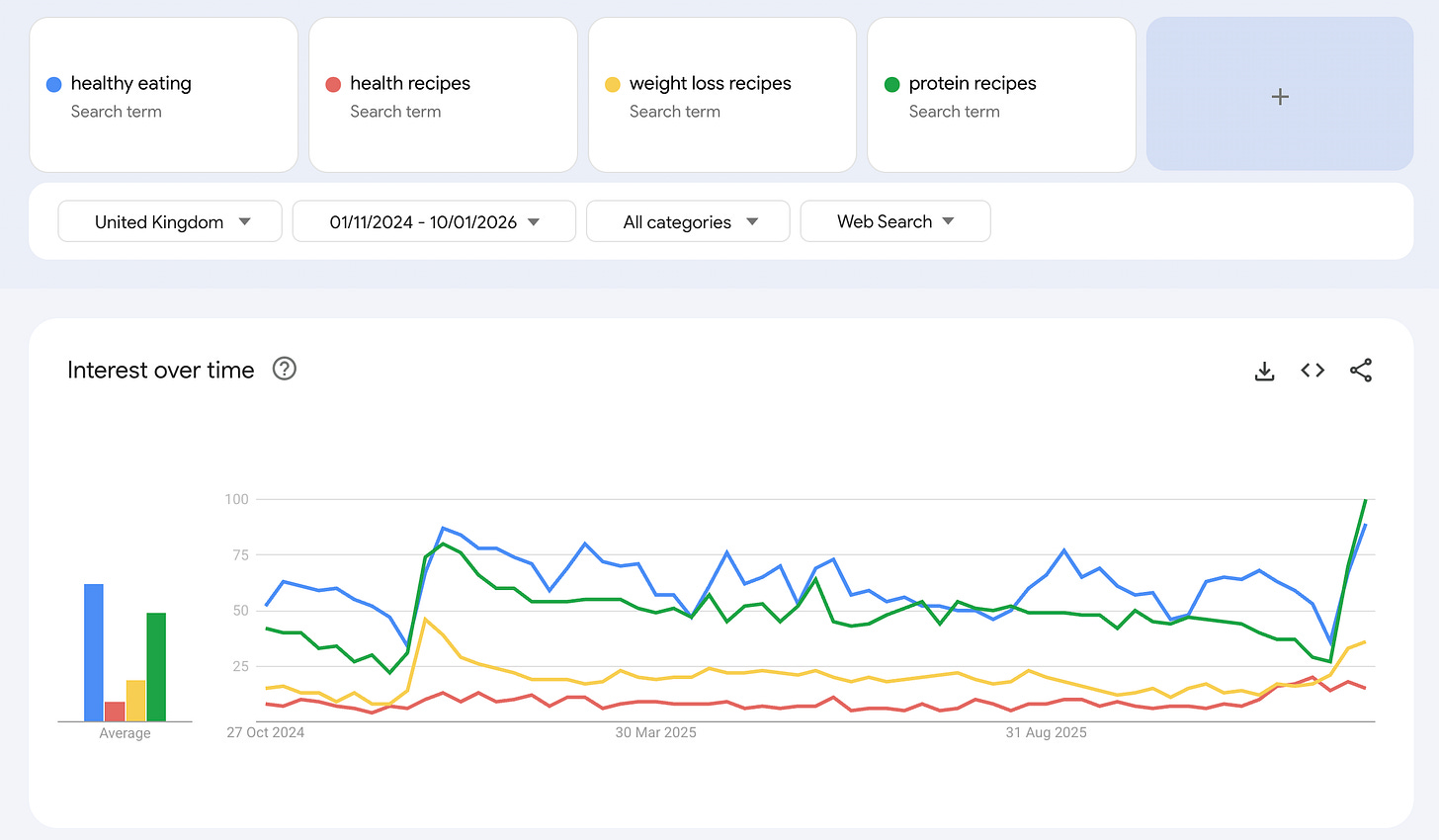

Looking at some of the example data comparing healthy eating habits. Weight loss recipes searches are down 25% year over year, while protein searches are up by the same degree. And while in absolute numbers, the cardio searchers are still much higher, those searching for intros to running are peaking less than those on a weight training kick.

Health: not just for January

All of our health, wellness, and adjacent brands had an excellent 2025 – but what made it excellent wasn’t a big January, but ongoing growth throughout the year.

One potential hypothesis I keep coming back to now is that the health and wellness market is much stronger and resilient year round, than it was a year ago. Yes organic search may be down in some categories, but is that because there’s a steady stream of regular customers joining those brands 12 months of the year (including in December).

The other view is that the model of health is shifting. The upward trend is towards strength and longevity, and the products and services we’re searching for and buying is shifting with it.

If it’s of interest, we’ll re-run this again towards the end of the month. But in the meantime, the question is: how is trading going for you? Leave a comment below.